| Overview |

|

|

| Q: |

What is a Security Device? |

| A: |

A Security Device is a small electronic device to protect our customers against Internet fraud. Every Security Device will be linked with only one Personal e-Banking customer profile. The device generates random security codes for one-time use, required to perform specific transactions, such as non-registered account transfers or bill payments to payees under category of e-Merchants.

| Security Device |

|

Alternatively, you can use Mobile Security Key which is a digital version of physical Security Device within the Hang Seng Personal Banking mobile app. Please click here to find out more about Mobile Security Key.

|

| |

|

| Q: |

What is a Security Code? |

| A:

| The Security Code is a one-time 6-digit random password generated by the Security Device. It will be used to verify your identity at Hang Seng Personal e-Banking. |

| |

|

| Q: |

What is a serial number? |

| A: |

Every physical Security Device has its own unique number at the back of the device. The number is a 10-digit serial number, identifying your individual Security Device, and will look something like xx-xxxxxxx-x where X is a number (e.g. 01-1234567-8).

To activate the physical Security Device, you must log on to Hang Seng Personal e-Banking and input this serial number (please exclude '-') to link the Security Device with your own e-Banking profile. |

| |

|

| Q: |

Why do I need a Security Device? |

| A: |

To improve online banking services and protect you against theft and possible fraud, Hang Seng Personal e-Banking has implemented an enhanced security credential - a Security Code generated via a Security Device, to verify your identity when you are performing specific transactions. |

| |

|

| Q: |

When do I need to use Security Device? |

| A: |

Security Device is required when you are performing specific transactions, including:

| - |

Transfer to non-registered accounts / payees (including small value limit) |

| - |

Pay bill to e-Merchants |

| - |

Raise daily transfer limits |

| - |

Trade securities and other investment products online |

| - |

Register new payee |

| - |

Register cross-border view & transfer |

| - |

Set up or amend Direct Debit Authorisations (including eDDA) to designated beneficiaries |

| - |

Change of Personal contact information |

| - |

Enroll to e-Bills |

| - |

Issue E-Cheque |

| - |

Reset Password online |

| - |

Request for ATM PIN and replace ATM Card |

| - |

Request for Credit Card PIN / Phone PIN / Spending Card PIN |

| - |

Replace Security Device |

|

| |

|

| Q: |

How can I get or renew a physical Security Device? |

| A: |

To apply for a Security Device, you can contact Customer Service Hotline at 2822 0228 and the Security Device will be mailed to your correspondence address. You can also collect a Security Device through our branch or by posting us the completed request form with a copy of your ID document. Please be reminded to set the respective daily limit for non-registered account transfers and / or bill payments to payees under category of e-Merchants before such transactions can be performed. |

| |

|

| Q: |

Do I need to pay for the physical Security Device? |

| A: |

The Security Device is free of charge on a first-time request. A replacement cost of HK$100 will be charged for subsequent request e.g. report loss. However, if the original Security Device is malfunction or its battery is running low, you will get a new Security Device free of charge. |

| |

|

| Q: |

Do I need to use the Security Device for every logon and transaction? |

| A: |

If you wish to perform non-registered account transfers, bill payments to payees under category of e-Merchants or Direct Debit Authorisation setup on designated beneficiaries, you MUST use the Security Device when performing the transaction. For logon, Personal e-Banking customers may use Security Device, as an alternative to Dual-Password option. |

| |

|

| Q: |

I have received a physical Security Device from Hang Seng Bank. Can I use it instantly? |

| A: |

No, you need to activate your Security Device via Activate Security Device under Customer Services section of Personal e-Banking. Besides, please be reminded to set the respective daily limit for non-registered account transfers and / or bill payments to payees under category of e-Merchants before such transactions can be performed. |

| |

|

| Q: |

Can the same Security Device be shared among different e-banking users? |

| A: |

Once you have activated the Security Device in Personal e-Banking, the Security Device becomes your own identity device and the Security Code (one-time password) generated could only be used by you for the associated Personal e-Banking profile. In other words, if your family member or friend has another Security Device for their Personal e-Banking service, you cannot use their device to generate a Security Code for your Personal e-Banking service. |

| |

|

| Q: |

I have registered both Personal and Business e-Banking services at Hang Seng Bank. Can I use the same Security Device? |

| A: |

No, each Security Device can only be linked with one e-Banking profile. If you have registered both Personal and Business e-Banking services, you should use separate Security Device for Personal and Business e-Banking respectively. |

| |

|

| Physical Security Device - Functionality |

|

|

| Q: |

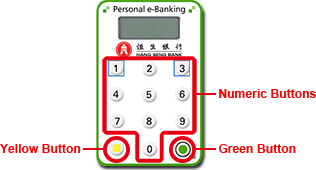

How do I use my Security Device to log on and when do I need to use the numeric buttons? |

| A: |

| - |

Numeric buttons - For inputting your Security Device PIN and transaction specific information. |

| - |

Yellow button at the bottom left - Press this button once after entering the transaction specific information, such as third-party account, to generate the Security Code for transaction.

[Security reminder: Only use the yellow button  at the bottom left when you intentionally proceed a transaction that requires the Security Code, such as Account Transfer to Third Party. The Bank will never provide you with a specific number and ask you to generate its Security Code.] at the bottom left when you intentionally proceed a transaction that requires the Security Code, such as Account Transfer to Third Party. The Bank will never provide you with a specific number and ask you to generate its Security Code.] |

| - |

Green button at the bottom right - Press this button once to generate a Security Code for logging on or to delete an incorrect input. |

|

| |

|

| Q: |

For the Security Device, I noticed that there are different formats of Security Code. Why is that? |

| A: |

The Security Device generates Security Codes in two different formats, which support different functions in Personal e-Banking:

| Security Code format |

How to generate (after the device is turned on and unlocked) |

Example of applicable functions |

| 123456 |

Press the green button  at the bottom right of the device on the device. at the bottom right of the device on the device. |

Personal e-Banking logon |

| 123 456 |

Key in transaction specific information into the device and then press the yellow button  at the bottom left. at the bottom left. |

Instruction verification on third-party account transfer |

|

| |

|

| Q: |

In what occasion(s) do I need to press the bottom-left  (yellow) button to generate a Security Code? (yellow) button to generate a Security Code? |

| A: |

To improve the security of our online banking services and protect you against online thefts and possible frauds, Hang Seng Bank has implemented an enhanced security credential - a Security Code generated via a Security Device based on your own transaction specific information, also known as Transaction Signing. Such measure is applicable to the following transactions:

| When you perform |

Transaction specific information |

| Transfers to non-registered accounts / payees (including small value limit) |

Beneficiary account number, email address, mobile number or FPS Identifier |

| Transfer foreign currency to thirty parties |

Beneficiary account number |

| Pay to e-Merchants |

Bill account number |

| Pay bill via e-Bills for designated beneficiaries |

Bill account number |

| Set up Direct Debit Authorisations to designated beneficiaries or eDDA |

Debtor reference, email address, mobile number or FPS Identifier |

| Update Personal Particulars |

Your identity document number (eg. HKID, Passport) |

To generate the Security Code, you are required to key in your transaction specific information to your Security Device and then press the yellow button  at the bottom left. The Bank will never provide you with a specific number and ask you to generate its Security Code with the yellow button at the bottom left.. at the bottom left. The Bank will never provide you with a specific number and ask you to generate its Security Code with the yellow button at the bottom left..

|

| |

|

| Q: |

Why is there a square on the "1" and "3" on the Security Device? Do they indicate any special meaning or function? |

| A: |

These are the reserved functions of the Security Device, but there is no particular usage or meaning associated to the two buttons at this moment. |

| |

|

| Setting up PIN for physical Security Device |

|

|

| Q: |

Why do I need to set up a PIN for the Security Device? |

| A: |

To safeguard your Security Device from easily accessible by third parties in case of loss, the Security Device is PIN-protected. You will have to set a PIN before you use it for the first time and this PIN will be required to unlock the device before each use. |

| |

|

| Q: |

Can I choose not to set up a Security Device PIN? |

| A: |

No, PIN setup is compulsory before you use the Security Device for the first time. |

| |

|

| Q: |

How many digits can I choose for the PIN? |

| A: |

You can only choose a 4-digit PIN for the Security Device. |

| |

|

| Q: |

How do I set up a new PIN? |

| A: |

Please refer to the steps in the Set up Security Device PIN demo for details. |

| |

|

| Q: |

What happens if my PIN setup is unsuccessful? |

| A: |

When a message "FAIL PIN" is shown on your Security Device, this represents that your confirmation PIN does not match the first PIN entered. You will need to start over the PIN setup process. |

| |

|

| Q: |

Can I change my Security Device PIN? |

| A: |

Yes, you can do so. Simply turn on and unlock your device with your current PIN, then press and hold "8" button for 2 seconds to enter the change PIN function. For details, please refer to the steps in the Change Security Device PIN demo. |

| |

|

| Turning on physical Security Device |

|

|

| Q: |

How do I turn on my Security Device? |

| A: |

Please refer to the steps in the Turn on Security Device demo for details. |

| |

|

| Q: |

Why do I see a "FAIL 1", "FAIL 2", "FAIL 3", "FAIL 4" or "FAIL 5" message on the device? |

| A: |

This is because you have entered an incorrect PIN. You will have a total of 5 attempts to enter a correct PIN before your Security Device is locked. |

| |

|

| Q: |

I have forgotten my Security Device PIN or my device is locked due to invalid PIN attempts. Can I reset the PIN? |

| A: |

Yes, you can do so. Simply log on to Personal e-Banking with Dual-Password, then visit "Reset Security Device PIN" under "Customer Services" section and follow the on-screen instructions. Please refer to the steps in the Reset PIN for Security Device demo for details.

If you have also forgotten your First Password for logging on to Personal e-Banking, please follow these steps:

| 1. |

Go to the Personal e-Banking logon page, enter your "Username"; |

| 2. |

Click "Password" button; |

| 3. |

Click "Forgot your password?" link; |

| 4. |

Answer two security questions and follow the on-screen instructions. |

|

| |

|

| Activating/Replacing physical Security Device |

|

|

| Q: |

How to activate or replace the Security Device? |

| A: |

Please follow the steps below to activate or replace the Security Device:

For first-time application of Security Device

| 1. |

Log on to Personal e-Banking. |

| 2. |

Select "Customer Services" > "Security Device" > "Activate Security Device". |

| 3. |

Follow the on-screen instructions to enter (a) the serial number of your device; (b) the verification code sent to your registered mobile number and; (c) the Security Code generated by your new device to complete the activation process. |

Please refer to the steps in the Activate Security Device (first-time application) demo for details.

For replacement of Security Device:

| 1. |

Log on to Personal e-Banking. |

| 2. |

Select "Customer Services" > "Security Device" > "Activate Security Device". |

| 3. |

Follow the on-screen instructions to enter (a) the Security Code generated by your OLD device; (b) the serial number of your NEW device and; (c) the Security Code generated by your NEW device to complete the activation process. |

Please refer to the steps in the Activate Security Device (replacement) demo for details. |

| |

|

| Q: |

Why do I need to have my updated mobile number registered in the Bank's record before I can activate a Security Device? |

| A: |

The Security Device will be the key to verify your identity at Personal e-Banking. To protect your interest, we will send you a verification code (for first-time application only) and notification to your registered mobile number during activation of the Security Device.

To review your registered mobile number, please select "Customer Services" > "Account Maintenance" > "Personal Particulars". You can update your mobile number at the same page (an activated Security Device is required) or by returning a completed Change Contact Information form to any of our branches. |

| |

|

| Q: |

Why do I need to have my old Security Device before I can activate a replacement Security Device? |

| A: |

To protect your interest, it is necessary to verify your identity with your old Security Device prior to replacement device activation. This is to avoid unauthorised third parties linking up your Personal e-Banking profile with a Security Device not held by you. |

| |

|

| Q: |

My old Security Device is broken or out of battery. How can I activate a replacement Security Device? |

| A: |

Please call our Customer Service Hotline on (852) 2822 0228 to deactivate your old device. Once your old device is deactivated, you will be able to activate your new device via Personal e-Banking. |

| |

|

| Q: |

I am using Personal e-Banking service with my company account. Why am I unable to activate a Security Device? |

| A: |

The Security Device at Personal e-Banking is designed for use by personal customers. Company customers are encouraged to switch to Hang Seng Business e-Banking service to enjoy a full-range of online services on business accounts. |

| |

|

| Transaction Signing with Security Device |

|

|

| Q: |

How does inputting transaction specific information into my Security Device increase the security level in Hang Seng Personal e-Banking? |

| A: |

The Security Device requires you to input transaction specific information (e.g account number, bill account number, etc.) into your device to generate a Security Code to authorise your transaction. With this additional transaction verification function, it further prevents fraudulent attacks as the transaction will only be made to the account specified by you. This layer of protection provides an increased level of security for your banking transactions.

[Security reminder: Only use the yellow button  at the bottom left when you intentionally proceed a transaction that requires the Security Code, such as Account Transfer to Third Party. The Bank will never provide you with a specific number and ask you to generate its Security Code.] at the bottom left when you intentionally proceed a transaction that requires the Security Code, such as Account Transfer to Third Party. The Bank will never provide you with a specific number and ask you to generate its Security Code.] |

| |

|

| Q: |

When do I need to input transaction specific information into my Security Device? |

| A: |

You need to input such information into your Security Device when you are performing the following transactions:

| - |

Account Transfers to Non-Registered Accounts |

| - |

Bill Payments to e-Merchants |

| - |

Setting up Direct Debit Authorisations to Designated Beneficiaries |

| - |

Updating Personal Particulars |

| - |

Register "New Payee" |

| - |

Raise daily transfer limits |

|

| |

|

| Q: |

How do I know what transaction specific information I need to input into my Security Device? |

| A: |

Please follow the on-screen instructions on the Security Code input page on Personal e-Banking to input the correct information into your Security Device and generate the required Security Code.

Examples of such instructions are shown below.

If you are:

- Making transfer to non-registered payee

- Making bill payment to payee under e-Merchant category

- Setting up Direct Debit Authorisation to designated beneficiaries

- Registering new payee

| Payee account number / Bill account number / Debtor / Proxy ID/ reference |

Instructions |

Example |

Input |

| With 8 or more digits |

Enter the last 8 digits only. |

123-4-567890

01234567 |

34567890

01234567 |

| With 4-7 digits |

Enter all digits. |

123456 |

123456 |

| With 0-3 digits |

Verification is not applicable at Personal e-Banking. Please perform your transaction at any of our branches. |

123

AB12CD3E |

(Not applicable) |

| Comprising numeric and non-numeric characters |

Skip all non-numeric characters. Enter the digits into the Security Device. |

00123A45B678E9

A12233 |

23456789

12233 |

| Email Address |

Enter the corresponding number assigned for each alphabet* of the email address, as follows:

*omit the special characters |

Enter first 2 characters: TA→82

Enter 2 characters before @: P1→71

Enter 2 characters after @: gm→46

Enter last 2 characters: om→66

|

82714666 |

123@A.Ru

Enter first 2 characters: 12→12

Enter 2 characters before @: 30 (add 0 if less than 2 characters)→30

Enter 2 characters after @: AR→27

Enter last 2 characters: u0(add 0 if less than 2 characters)→80

|

12302780 |

| #Proxy ID includes phone number, email address and FPD Identifier. |

If you are:

- Updating your personal particulars

- Raising Transfer Limit

| Identification document |

Instructions |

Example |

Input |

| HKID number |

Enter all digits, except all non-numeric characters and the number in bracket. |

A123456(7) |

123456 |

| Passport or other identification document number with 8 or more digits |

Enter the last 8 digits only. Skip all non-numeric characters. |

12345678

A1234B567CD890 |

12345678

34567890 |

| Passport or other identification document number with 4-7 digits |

Enter all digits. Skip all non-numeric characters. |

456789

A34BC56DE78 |

456789

345678 |

| Passport or other identification document number with 0-3 digits |

Verification is not applicable at Personal e-Banking. Please make your request at any of our branches. |

AB12CD3EF |

Not applicable |

|

| |

|

| Q: |

What should I do if I have entered a wrong number into my Security Device during the verification process? |

| A: |

If you have entered a wrong number into your Security Device, press the green button  at the bottom right to delete your last entry. To clear all of your input, press and hold the green button at the bottom right to delete your last entry. To clear all of your input, press and hold the green button  at the bottom right. at the bottom right. |

| |

|

| Q: |

The Security Code on the display has been disappeared after a while, why? |

| A: |

To protect your interest, the Security Device will automatically power off after a short period of time. If the Security Code disappears, please repeat your steps to turn on and unlock your Security Device for generating the Security Code again. |

| |

|

| Q: |

What should I do if the Security Code I have input on Personal e-Banking is not accepted? |

| A: |

| 1. |

Please ensure the Security Code you have input matches the Security Code displayed on your Security Device. |

| 2. |

If the Security Code matches the digits shown in your device, the transaction specific information entered previously may be incorrect; or your Security Code may have expired because you took longer than the time limit to enter it. |

| 3. |

Please follow the on-screen instructions and repeat the process to generate a Security Code. |

If the Security Code is still not accepted, please contact us on (852) 2822 0228. |

| |

|

| Q: |

If I input incorrect information into the device, will this affect my instruction? |

| A: |

The Security Device will generate a Security Code according to the transaction specific information entered by you. If you have input incorrect information to the device, your Security Code generated will therefore be invalid. Please ensure you input correct information. |

| |

|

| Q: |

Are there any arrangements specially designed for customers who are visually impaired or blind? |

| A: |

There is a Security Device specially designed for customers who are visually impaired. Customers can request for the Security Device by calling us on (852) 2822 0228. |

| |

|

| Troubleshooting of physical Security Device |

|

|

| Q: |

How long will the battery of the Security Device last? |

| A: |

The normal lifespan of the battery is three to five years, depending on the frequency of the usage. A "BATT#" message appears when your Security Device's battery is running low.

For example, "BATT5" means 5 weeks estimated battery life remaining. "BATT0" means battery life is exhausted. |

| |

|

| Q: |

The battery of my Security Device is running low. How to replace the battery? |

| A: |

The battery in your device cannot be replaced. Please call our Customer Service Hotline at 2822 0228 to apply for new Security Device which will be mailed to your correspondence address. |

| |

|

| Q: |

What should I do if my Security Device is lost or broken? |

| A: |

Please call our Customer Service Hotline at 2822 0228 to deactivate the lost or broken device and apply for the new Security Device which will be mailed to your correspondence address. |

| |

|

| Disposal of old physical Security Device |

|

|

| Q: |

How should I handle my old Security Device after activating the new Security Device? |

| A: |

Upon activation of the new Security Device, your old Security Device will no longer be valid for your e-Banking transactions. Please dispose of your old Security Device properly. |